The initial investment is $11 million, and the project will last for five years, with the following estimated cash flows per year. The ability to track investments in real time helps businesses maintain better control over their capital allocation decisions. Manufacturers apply capital budgeting techniques to evaluate investments in new machinery, automation systems, and production line upgrades.

Common Challenges When Performing a DCF Analysis

Estimating too highly will result in overvaluing the eventual payoff of the investment. Likewise, estimating too low may make the investment appear too costly for the eventual profit, which could result in missed opportunities. Automated systems can quickly generate comprehensive reports that provide key insights into investment performance and capital allocation. Automation tools utilize advanced algorithms and historical data to generate more accurate cash flow forecasts.

Provides Insight Into a Company’s Future Performance

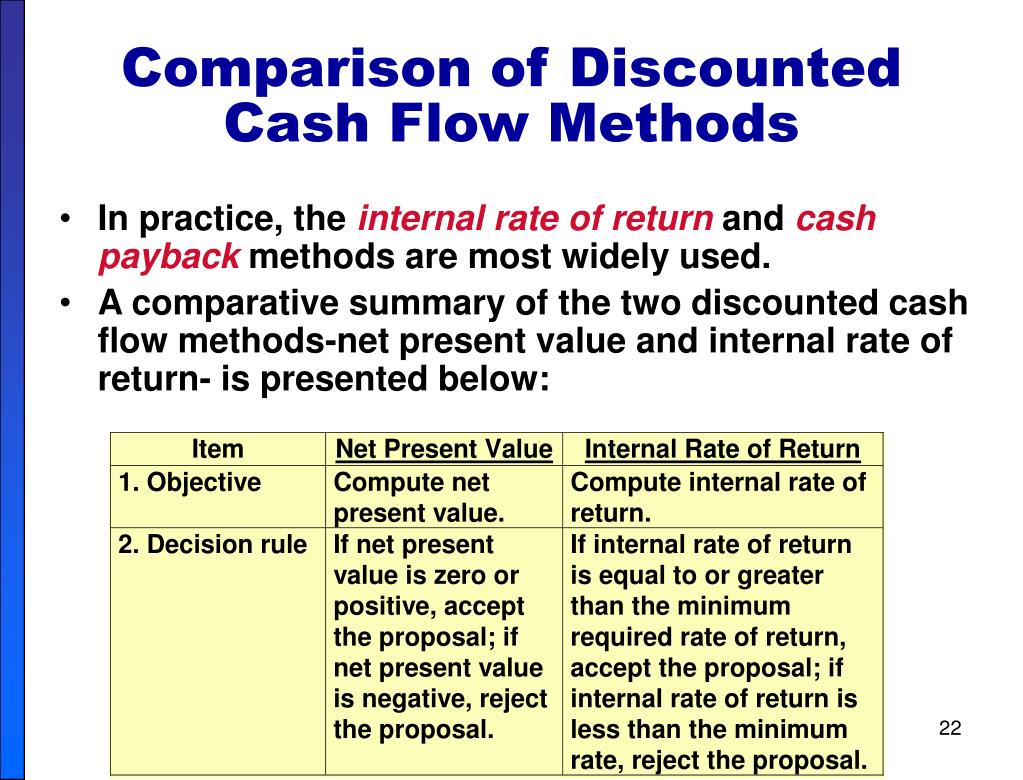

In order for the IRR to be considered a valid way to evaluate a project, it must be compared to a discount rate. If a discount rate is not known, or cannot be applied to a specific project for whatever reason, the IRR is of limited value. If a project’s NPV is above zero, then it’s considered to be financially worthwhile. The market rate of return on investing money today, tells us how much more that money will be worth in the future because it earns a return.

Role of discount rates in capital budgeting techniques

Much like any other valuation method, the DCF model was designed for a specific application with certain assumptions, which means it has a few limitations that you need to be aware of. This is because the DCF model can be used to estimate the intrinsic value of both companies involved in the transaction. As a result, the DCF model can be used to predict how a company’s stock price will move in the future. If it is otherwise, it could signal that the investment is likely to be unprofitable and should be avoided. Net Present Value (NPV) is the difference between the initial cost of an investment and its present value. These security measures help organizations maintain the confidentiality and integrity of their financial data.

How to calculate a DCF model in Excel

- It is still widely used because it’s quick and can give managers a “back of the envelope” understanding of the real value of a proposed project.

- Another challenge when using the DCF model is estimating the correct discount rate to use.

- The corresponding interest rate at the number of periods (\(n\)) is the IRR.

- Understanding how these techniques are applied in real-world situations can provide valuable insights into their practical utility.

The minimum required rate of return (20% in our example) is used to discount the cash inflow to its present value and is, therefore, also known as discount rate. When the NPV is determined to be \(\$0\), the present value of the cash inflows and the present value of the cash outflows are equal. For example, assume that the present value of the cash inflows is \(\$10,000\) and the present value of the cash outflows is also \(\$10,000\). If you were to then calculate the internal rate of return, the IRR would be \(8\%\), the same interest rate that gave us an NPV of \(\$0\). Let’s say Rayford Machining has another option, Option B, for a drill press purchase with an initial investment cost of \(\$56,000\) that produces present value cash flows of \(\$60,500\). Additionally, a company would determine whether the projects being considered are mutually exclusive or not.

Simplify your capital budgeting process with Volopay!

ARR ignores the the time value of money, uses accounting profits instead of cash flows, and doesn’t consider the timing of returns. It may provide misleading results for projects with uneven profit patterns or different life spans. IRR provides a straightforward what is black friday percentage return metric that’s easily comparable across investments. It accounts for the time value of money, considers all cash flows throughout project life, and offers an intuitive measure of investment efficiency that managers understand well.

The terminal value is usually estimated using a multiple of earnings or cash flow. The DCF model can provide valuable insight into a company’s future performance. In contrast, other valuation methods such as the price-to-earnings (P/E) ratio only consider a company’s historical earnings. The model can also decide whether or not it is more beneficial for one company to acquire another or if it would make sense for both businesses to merge. In the case of a merger, the DCF model is used to determine the value of each company and how much they should be worth together. Since the total present value or DCF is less than the cost of the investment, we can conclude that the investment is not worthwhile.

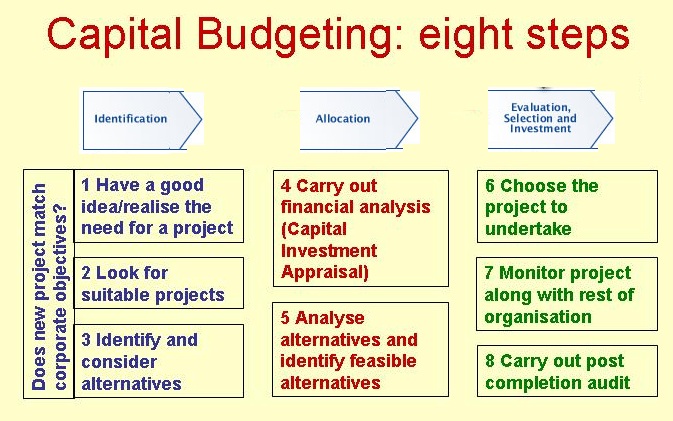

Companies must carefully evaluate each project’s contribution to overall organizational objectives while considering resource limitations. Time value of money principles provide the basis for calculating key profitability metrics like NPV and IRR. The availability and cost of different funding sources can influence project selection and timing. These preferences often reflect the organization’s culture, goals, and long-term strategic objectives.