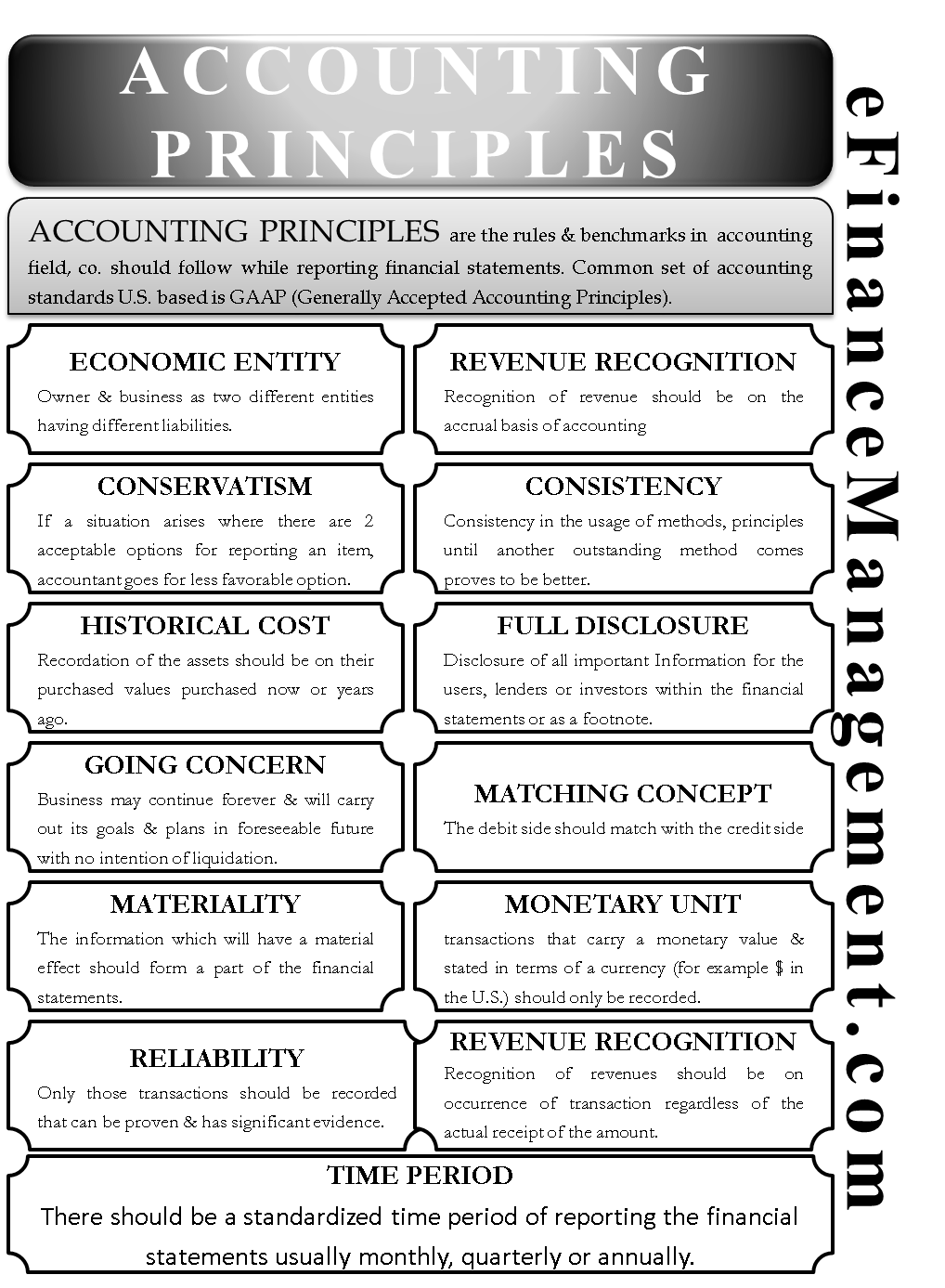

Accounting principles help hold a company’s financial reporting to clear and regulated standards. In the United States, these standards are known as the Generally Accepted Accounting Principles (GAAP or U.S. GAAP). Companies required to meet GAAP standards must do so in all financial reporting or risk facing significant consequences.

Key Principles of GAAP

The procedural part of accounting—recording transactions right through to creating financial statements—is a universal process. Businesses all around the world carry out this process as part of their normal operations. In carrying out these steps, the timing and rate at which transactions are recorded and subsequently reported in the financial statements are determined by the accepted accounting principles used by the company. Accounting principles are the common guidelines and rules related to accounting transactions that are followed to prepare financial statements successfully. These principles are the founding guidelines for preparing and recording financials for proper analysis. These accounting principles are also known as Generally Accepted Accounting Principles or GAAP.

Accounting Concepts and Principles FAQs

This book is perhaps the most comprehensive text I have seen for financial accounting. For those who are familiar with Financial Accounting, the index and glossary are sufficiently detailed. The fact that the text is so comprehensive is both a positive and a negative. It is positive in the sense that it has essentially every topic that you may want to cover in an introductory course.

- We believe everyone should be able to make financial decisions with confidence.

- Equity capital specifies the money paid into a business by investors in exchange for stock in the company.

- I like the review section at the end of the chapter that reiterates, again, the main points of the chapter in a slightly different way adding another layer of clarity for the reader.

- It includes the amounts of comprehensive income not reported on the income statement.

- It allows for the valuation of assets and liabilities as if the business will continue to operate, fostering realistic financial reporting.

- Even though Lynn feels the equipment is worth $60,000, she may only record the cost she paid for the equipment of $40,000.

Debits and Credits

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. For instance, GAAP allows companies to use either first in, first out (FIFO) or last in, first out (LIFO) as an inventory cost method. Katrina Ávila Munichiello is an experienced editor, writer, fact-checker, and proofreader with more than fourteen years of experience working with print and online publications.

Auditing of Publicly Traded Companies

Suppose a company ships its goods amounting to ₹10,000 to its customer on the credit of 30 days. The company will realise the same as soon as the goods have been shipped even though it will receive the amount in the future. The cost concept of accounting states that an organization should record all of its assets at their how to claim the property tax deduction purchase price in the books of accounts. This amount also includes any transportation cost, acquisition cost, installation cost, and any other cost spent by the firm for making the asset ready to use. It has also spent a sum of ₹10,000 on transportation, ₹20,000 on its installation, and ₹15,000 on making it ready to use.

The Internal Revenue Service also requires consistency for the purpose of filing small-business taxes. If you choose an accounting method and later want to change it, you must get IRS approval. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

Let’s say there were a credit of $4,000 and a debit of $6,000 in the Accounts Payable account. Since Accounts Payable increases on the credit side, one would expect a normal balance on the credit side. However, the difference between the two figures in this case would be a debit balance of $2,000, which is an abnormal balance.

Chief officers of publicly traded companies and their independent auditors must certify that the financial statements and related notes were prepared in accordance with GAAP. The International Financial Reporting Standards (IFRS) is the most widely used set of accounting principles, with adoption in 168 jurisdictions. The United States uses a separate set of accounting principles, known as generally accepted accounting principles (GAAP). The consistency principle encourages uniformity in accounting methods from one period to the next. It promotes comparability of financial statements over time, allowing stakeholders to analyse trends and make informed decisions.

OpenStax does a good job of working an editorial process that eliminates any culturally insensitive content. The chapters might be distracting or require modification but the interface was straight-forward. I gave the text 3/5 as being both accessible prose and inaccessible (confusing) prose, adequate content and inadequate content. It is a sold text book that would require significant modification and adaptation to work for me. Joe has also met with an attorney to discuss the form of business he should use. Given his specific situation, they concluded that a corporation will be best.

If the business will stay operational in the foreseeable future, the company can continue to recognize these long-term expenses over several time periods. Some red flags that a business may no longer be a going concern are defaults on loans or a sequence of losses. The revenue recognition principle directs a company to recognize revenue in the period in which it is earned; revenue is not considered earned until a product or service has been provided.